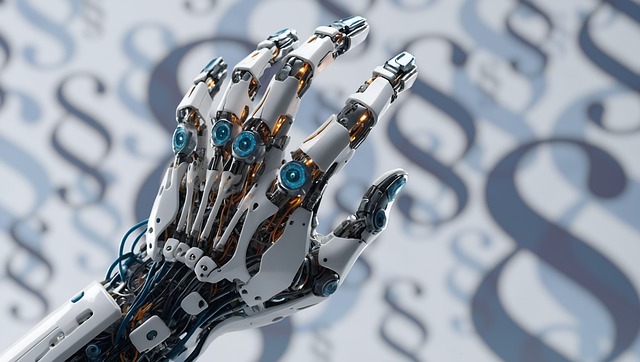

Criminal Defense Attorneys are vital navigators in the complex world of Litigation Challenges in Financial Regulatory Compliance, especially for high-stakes cases involving white-collar and economic crimes. They guide clients through investigations, interpret legal frameworks, and employ strategic defenses to protect against non-compliance allegations. By leveraging expertise in forensic accounting, attorney-client privilege, and legal loopholes, these attorneys strive for complete charge dismissals, safeguarding client interests and reputations in the financial sectors where regulatory actions can be severe.

Criminal defense attorneys play a pivotal role in financial regulatory cases, ensuring fair representation for those accused of regulatory violations. This article delves into the intricate world of these legal professionals, highlighting their essential duties and strategies. From navigating complex litigation challenges in financial regulatory compliance to understanding common pitfalls, this guide offers insights into effective defense tactics. Discover how attorneys mitigate legal risks, providing a crucial safety net against severe penalties for individuals and businesses alike.

- The Role of Criminal Defense Attorneys in Financial Regulatory Cases

- Common Litigation Challenges and Strategies for Defense

- Navigating Compliance Requirements to Mitigate Legal Risks

The Role of Criminal Defense Attorneys in Financial Regulatory Cases

Criminal Defense Attorneys play a pivotal role in navigating the complex landscape of financial regulatory compliance, especially in high-stakes cases involving intricate litigation challenges. These attorneys are instrumental in guiding clients through all stages of the investigative and enforcement process, ensuring that their rights are protected and that justice is served.

They specialize in interpreting complex legal and regulatory frameworks, helping businesses to understand their obligations and liabilities. By employing strategic defense mechanisms, they safeguard their clients’ interests, offering expertise in constructing robust defenses against allegations of non-compliance. This is particularly crucial in financial sectors where regulatory actions can have severe implications for respective business operations and reputations.

Common Litigation Challenges and Strategies for Defense

Criminal Defense Attorneys often face unique challenges when representing clients in cases involving Litigation Challenges in Financial Regulatory Compliance. These cases, typically encompassing white collar and economic crimes, demand a deep understanding of complex legal frameworks and industry-specific regulations. One common hurdle is navigating intricate financial records, which may be scattered across various institutions and jurisdictions. Effective strategies include meticulous document review, employing forensic accounting experts to unearth relevant information, and utilizing the attorney-client privilege to ensure confidential communications are protected.

Moreover, achieving a complete dismissal of all charges requires a multifaceted approach. Defense attorneys can challenge the admissibility of evidence by raising concerns about illegal search and seizure practices or the reliability of witness testimonies. They may also exploit procedural gaps in the prosecution’s case, such as violations of the client’s constitutional rights. A successful defense often relies on meticulous preparation, leveraging legal loopholes, and presenting a compelling narrative that shifts the burden of proof back to the accusers.

Navigating Compliance Requirements to Mitigate Legal Risks

Navigating complex legal landscapes is a cornerstone of Criminal Defense Attorneys’ expertise. They play a pivotal role in guiding clients through intricate web of regulations, particularly in cases involving financial institutions and transactions. Litigation Challenges in Financial Regulatory Compliance present unique hurdles that demand meticulous attention to detail.

Attorneys must meticulously assess and interpret a myriad of rules and guidelines to ensure their corporate and individual clients avoid legal pitfalls. By staying abreast of legislative changes and regulatory updates, they can proactively identify potential risks and take necessary steps to mitigate them. This proactive approach not only aims to protect clients from the burden of fines and penalties but also strives for the complete dismissal of all charges in favorable circumstances, thereby fostering trust within philanthropic and political communities.

Criminal defense attorneys play a pivotal role in financial regulatory cases, where navigating complex legal landscapes and understanding compliance requirements are paramount. By employing strategic defenses against common litigation challenges, such as intricate regulations and evolving legal precedents, these attorneys ensure their clients’ rights are protected. Ultimately, staying ahead of the curve in terms of regulatory compliance is key to mitigating risks and achieving favorable outcomes in financial regulatory litigation.